Our fortnightly podcast following the UK venture capital industry. Dr Brian Moretta explores small growth companies, as well as the funds and people who invest in them.

The EIS Navigator podcast is for those interested in the UK venture capital industry, particularly the areas that are supported by government schemes. These include the Enterprise Investment Scheme, EIS, Seed Enterprise Investment Scheme, or SEIS, and Venture Capital Trusts. This means we are looking at small, growth companies – often at the startup stage.

We interview leading people in the industry, whether fund managers, company founders or experts from other service providers. The aim is to dig deeply into topics, getting away from the promotional material that predominates elsewhere. Venture capital investing is a long-term endeavour and we will focus on topics that are relevant at any time.

Quickly and easily listen to The EIS Navigator in your podcast app of choice, including Spotify and Apple Podcasts.

Subscribe and listen nowWe are excited to launch EIS & VC Basics, a brand-new mini-series within The EIS Navigator Podcast. This series breaks down the essentials of the UK’s three major venture capital schemes: the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), and Venture Capital Trusts (VCTs).

Each short episode features insights from leading fund managers and our analyst, Dr Brian Moretta.

Find out moreNew episodes are released every second Tuesday at 7:00am.

Explore the full archive of episodes

Founding a new VC firm isn’t easy, and one headed by two women is exceptionally rare in the UK. Jessica Rasmussen co-founded Two Magnolias to invest in underrepresented founders and the regions so can tell us all about the challenges of founding and building a female-led firm.

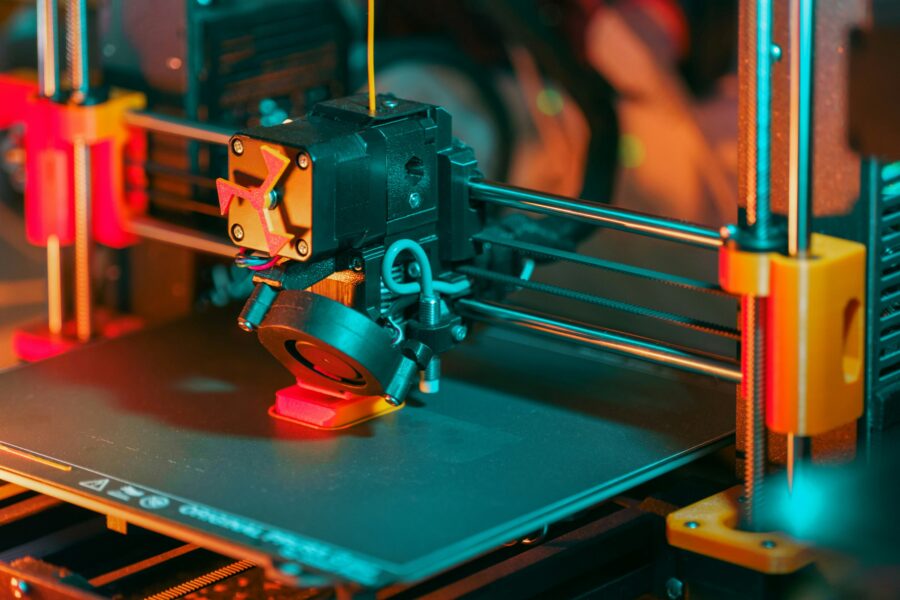

Deep maketech is not well known to investors, but is the theme that Everquest Capital Partners focus on. In this episode, Partners Stephane Mery and Hannah Wade discuss this blend of technology and manufacturing and its attractions to investors.

Now the successful Basics series is complete, we return to normal programming with our usual year-end panel. An all-star group of experts get together to discuss what happened in EIS and VCTs in 2025 and the prospects for 2026. This […]

Your host, Brian Moretta, is Head of Tax Advantaged Services at Hardman & Co. He is an actuary turned fund manager, who then moved into equity research, and has examined many EIS funds, VCTs and companies. He also has some academic chops, being an Honorary Fellow at Heriot-Watt University where he does some occasional teaching. He has always had a strong interest in getting underneath companies and understanding how they really work, and he finds this space fascinating. Some of this is because transparency is hard, some because the industry is not well understood. The EIS Navigator podcast is an attempt to get beyond the superficial and shine a bit more light on what is going on.

Brian Moretta received Highly Commended at the EISA awards in 2021 and 2022 for the category Best Journalist or Advocate.

To contact us or give feedback, whether about the podcast or anything else, please email [email protected].