Our fortnightly podcast following the UK venture capital industry. Dr Brian Moretta explores small growth companies, as well as the funds and people who invest in them.

The EIS Navigator podcast is for those interested in the UK venture capital industry, particularly the areas that are supported by government schemes. These include the Enterprise Investment Scheme, EIS, Seed Enterprise Investment Scheme, or SEIS, and Venture Capital Trusts. This means we are looking at small, growth companies – often at the startup stage.

We interview leading people in the industry, whether fund managers, company founders or experts from other service providers. The aim is to dig deeply into topics, getting away from the promotional material that predominates elsewhere. Venture capital investing is a long-term endeavour and we will focus on topics that are relevant at any time.

Quickly and easily listen to The EIS Navigator in your podcast app of choice, including Spotify and Apple Podcasts.

Subscribe and listen now

Governance is all too often seen in startup companies as a chore, or necessary evil, when it it is really a positive and will enable success. The founder of SEEIO is trying to bring more of the latter to the venture world.

Getting big returns in venture capital can involve stepping away from the mainstream and investing in opportunities that others won’t. We ask Will Gibbs about being a contrarian investor, how to do it well and what needs to change to create a successful investment.

With much discussion about whether we are at the bottom of the current cycle, it seems a good time to revisit and we invited back someone who has experienced several market cycles: the co-founder of Calculus.

When we last spoke with Harry Heartfield of Edition, the leisure sector was all about recovering from the pandemic. We thought it was time to ask him back to discuss where we are now, how his investment philosophy has evolved and what the prospects for exits are now.

This is the second part of our excellent discussion looking at how to assess companies for venture capital investment. In this episode, we discuss scaling the UK venture capital industry, indexation and investing at scale.

Assessing companies for venture capital investment is often more of an art than a science. Richard Blakesley, Founder and CEO, is trying to change that with Venture Cubed. Its rating system aims to objectively assess how investible new companies are.

Investing in companies that are starting out presents different challenges from when they are more established. Oxford Technology has probably been investing in new science and technology companies for longer than anyone else in the (S)EIS world.

Cristiana Stewart-Lockhart, Neil Cole and Kealan Doyle join Brian Moretta to pick through events of 2023 and prospects for 2024 in UK VC, (S)EIS and VCTs.

In this episode, we take another look at debt funding for high growth companies. Juice has a novel approach using marketing data and its CEO, Katherine Chan, comes on to discuss this and the wider funding market.

Amongst EIS funds and VCTs, the consumer companies space is less popular than B2B investments but still has its attractions. VGC Partners is one of the few managers that focuses on this area and we hear from Investment Director, Phoebe Scriven.

B2B SaaS is a very popular business model amongst venture capital and (S)EIS/VCT investors. Haatch Ventures specialises in investing in this area and talks about how they work and how they help the companies scale.

While there is much discussion in the media of the macroeconomy, its effect on startups is not always as obvious as it is for quoted companies. Ewan MacKinnon at Maven draws on his considerable investing experience to give us some insights.

Having worked with many startups, Elliot Limb has a broad insight into their challenges and difficulties. We planned to focus on fintech, but ended up with a much wider discussion – essential listening for any founder, VC or investor.

Since its founding eight years ago, British Business Bank has established itself as an important participant in the funding markets for UK SMEs and start ups. Its CEO, Louis Taylor, tells us what it is doing and how it is going about it.

Hardware startups have often struggled to get funding, but Damon Bonser of British Design Fund is trying to change that. In this episode, he talks about his experiences and how hardware can be more attractive than many investors think.

Anyone with a passing interest in technology or venture capital cannot have missed the rapid increase in interest in AI over the past few months. We are overdue talking about it on the podcast, so we asked an expert in.

Kealan Doyle of Symvan Capital told a story about a venture capital conference where the compère asked who had been through a downturn before and nobody raised their hands.

Listen to the second part of this discussion on how recent changes will affect how ESG is applied in practice by fund managers, advisers and, most importantly, investors.

There have been two recent changes that will affect how ESG is applied in practice to fund managers, advisers and, most importantly, investors. Listen to this great discussion released as the first of two parts.

Healthcare is a large industry and is a lot more than just drugs. We have two experts from Deepbridge to discuss the industry and how there are a lot of other life science areas that are attractive to venture capital investors.

Venture debt is a niche within the venture capital market that has been growing in importance. In this episode we ask the Head of Venture Debt at Hambro Perks to explain what venture debt is and how it works.

In today’s episode, we get more of a corporate finance perspective on venture capital, with two guests from PwC. Antonia Burridge co-founded the Raise team and John Baker is heavily involved in equity crowdfunding, so we get a perspective that extends right across the market.

While we usually focus on EIS and VCT in this podcast series, there is a larger venture capital industry outside this area. Although it has been mainly for institutional investors to date, Sprout is looking to change that.

Exits were described by an earlier guest as mythical beasts, but the reality is much more positive. Henry Whorwood, Head of Research at Beauhurst, used its database in the report that it published in 2022 and discusses the trends that the report shows.

The EIS Navigator’s host, Brian Moretta, has spent much of his career analysing financial companies, so is uniquely placed to give insights on banking and venture capital in this solo episode.

Agricultural technology is an area that hasn’t quite hit the heights of some other areas of technology venture capital. In this episode, Paul Rous discusses how and why that is changing, with a more promising future ahead.

In venture capital investing, it is easy to focus on the excitement of doing deals, but in reality all the hard work happens after investment is made. Ben Leslie tells us how fund managers can support companies and help them achieve their goals.

Venture building has only one representative amongst SEIS and EIS fund managers, but Andy Davidson of Nova strongly believes it will become more important in the future. We get him to explain how venture building works and why he’s so bullish.

Raising money through angels or fund managers is something that most management does, at best, infrequently. For SEIS, EIS and VCT money, it’s often the first time founders have sought equity. Richard Cooper has lots of experience to help founders prepare.

Although investing on AIM through EIS funds and VCTs would appear to have several attractions, there are very few fund managers who invest in this area. Seneca Partners is one and we get fund manager Matt Currie to talk about it.

Christiana Stewart-Lockhart, Director General of the EIS Association, Neil Cole, Head of Wealth Planning Solutions, UBS Wealth Management, and Kealan Doyle, Director of Symvan Capital join Brian to pick through the events of 2022 and the prospects for 2023.

Harry Heartfield specialises in the leisure sector and gives insights into its past, present and future.

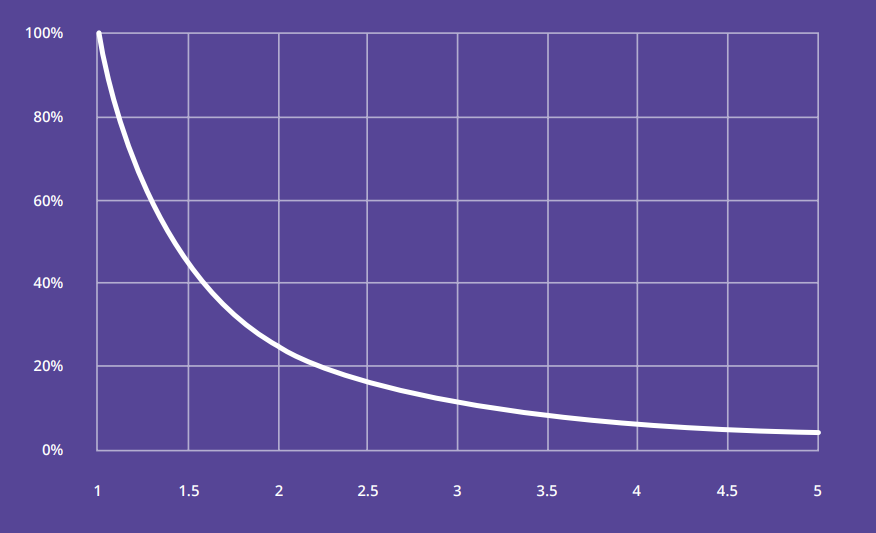

The power law is something that most venture capital investors are aware of, but usually in the most general sense. Graham Schwikkard has just written a white paper on the topic using its data-driven approach.

The lack of secondary market liquidity has been a long-term challenge, especially for companies that are not venture scale but still viable. Rufus Pearl is trying to improve that with a new scheme for investors.

While the business world is an ever-changing place, we seem to be in an exceptional time of flux. Reuben Wilcock has seen many small growth companies pivot and adapt and we tap into his knowledge.

How should a fund invested choose which VCT or EIS fund to give their money to? In this episode, Ewoud Karelse discusses what to look at and gives a wealth of tips.

The biotech industry attracted huge amounts of capital during the pandemic, but how is it faring in the post-pandemic world? Sunil Shah of o2h Ventures returns to give us an update on what’s been happening.

While we have focused on venture capital and EIS/VCT investors on the podcast, ultimately it is all about the companies that we invest in. Here we find out about two of them, together with the EIS fund managers who invested in them.

We start off with an outline of what’s happened in the past couple of years and where the market is now. Dave talks about what is or is not a reasonable valuation, with a particular focus on SaaS companies, and draws on examples to give us an idea of what he is seeing.

Edtech is far from uncommon in EIS investing, but is still a little away from the mainstream. We talk about why the target customers may not be who we think they are and dive into the eight-year journey with Boclips.

After introducing the deal itself, we discuss some of the motivations for the transaction and where Foresight sees complementarity with its existing business.

Michael Vassallo discusses the pros and challenges of investing in North East England and some of the reasons why the UK regions get less investment funding than the South East.

Andrew talks about ESG generally and gives a framework for how he thinks about different types of ESG. We discuss how the market looks at these things and outline some of the challenges.

Platforms are part of the essential plumbing for advisers and investors in most investment areas, but the tax-advantaged space has lagged mainstream markets. Dan Rodwell discusses how GrowthInvest is looking to change it.

It’s rare for an IFA firm to be started from scratch, and even rarer for it to have a preference for tax-advantaged or efficient business like EIS, VCTs, BR and SEIS products. One Four Nine is an IFA firm that does just that.

We discuss the angel market and its structure, the rise in “tourists”, how experienced investors have recently been cautious and what effect that will have. We also touch on syndicate structures and whether investors are getting value for money.

Returning to excerpts from previous guests by Tom Britton of SyndicateRoom, Sanjeev Gordhan who was then at Newable, Stephen Page of SFC Capital and Paul Tselentis of 24 Haymarket.

Head of Corporate Development at JP Jenkins comes onto the podcast to discuss the state of play and prospects for things getting better.

Richard Hoskins speaks with almost all of the new venture capital entrants and discusses the challenges and pitfalls for those who want to start a new fund or invest in one.

Andy Bloxam gives an insight into the unique relationship between Foresight and Williams Advanced Engineering in the EIS and VCT space.

Doug Lawson talks about the issues around data, how patterns emerge when there is enough data and the extent to which processes can be automated with AI and when an analytical input is needed.

St. James’s Place is the biggest writer of business across the whole tax-advantaged market. Luke Barnett discusses how the company looks at individual products, how it weighs up the different strategies, and how it evaluates teams and track records.

VGC Partners’ focus on consumer and digital media is somewhat unusual in the sector and we effectively do a case study of one of VGC’s investments.

Social impact investing is an area that sounds good in principle but is often not well understood by those not involved in it.

Most angel networks start organically, with the members drawn from a geography or having a particular interest but 24Haymarket has taken a different approach, with a distinct philosophy.

Mark Brownridge, Neil Cole and Kealan Doyle join Brian to pick through the debris of 2021 and the prospects for 2022.

The recent COP26 conference has stimulated a surge of interest in how we can make a difference as investors.

Andrew Aldridge steps into the host seat to discuss Brian Moretta’s recently published White Paper on how venture capital fits into retail investor portfolios, with some surprising results.

We discuss the difference between ESG and genuine impact investments and how this is leaving advisers and investors somewhat confused.

Stephen Page discusses the rather worrying trends in the SFC Capital and Beauhurst report about the seed investing market.

Bevan Duncan returns to the podcast to discuss the deal and its rationale. We also discuss how the new company will operate, what opportunities it may bring and chat about investor demand.

Lucius Cary first raised money for a small restaurant chain in the late 1970s. The difficulties of doing that inspired him to start a newsletter connecting start-ups and investors. Four decades later, he is on the seventh iteration of his fund.

A long-term perspective on how the market and the Calculus investment process has changed over time.

Scott Weavers-Wright is a serial entrepreneur. When we had him on last year, we only managed to discuss one of his first exits so we had to get him back for more.

Investors and founders all too often see legals as a necessary evil. SeedLegals is changing that, thinking about how to get better solutions for all parties.

Video gaming is a huge market, but relatively niche within EIS. Steve Iles has spent his whole career working in and helping the video games industry and his current focus is at the intersection with funding.

This is the second part of a really good discussion split over two episodes, where Stephen goes into detail about EIS and VCT product selection.

EIS and VCTs have been described by several guests as one of finance’s best kept secrets, which makes the job of advisers challenging when they recommend them.

International expansion is key to success for many startups, but also fraught with difficulties. We discuss timing, local partners, and overcoming language barriers.

We’ve touched on angel investing several times on the podcast, so it was time we got a business angel on.

Generating sales is critical for any business, so it’s good to get someone on who has a playbook that works.

While multi-stage venture capital management is common in the US, few firms have, so far, managed to develop it successfully here.

We all can see big ideas, but it’s often not clear how to translate them into investible ideas.

Do corporate financiers or former entrepreneurs make better venture capital investors?

Although consumer markets are a big part of quoted markets, they are something of a niche in EIS & VCTs. We hear from a specialist.

Product market fit is a much discussed, and much misunderstood, topic in venture capital.

We love a good entrepreneurial story and Jasper Smith has a great one.

Although investing in drug development seems ideal for EIS investment, it has been somewhat niche. We talk about how investing in the industry has evolved over the last couple of decades.

Venture capital has long been dominated by idiosyncratic decision making, so SyndicateRoom’s systematic data-driven approach is genuinely unique.

Most VCT and EIS investors have knowledge of quoted equity markets, but listed investments using these schemes differ from the mainstream.

Marketing is a make or break area for almost all startups. Having started his career in advertising, Rajeev is an expert, and we probe his knowledge to get insight for both investors and startups.

2020 has been a challenging year for many and the EIS industry is no exception. The EIS Navigator team have got together an all-star panel to discuss what happened.

Measuring sustainability is not a trivial challenge. Max and Jake talk us through the options for startups and small companies.

Ian Warwick worked in various executive roles in the US before founding Deepbridge. We focus on Aftersoft, a software company that Ian turned round and put on course for a successful exit.

Scott Weavers-Wright achieved two very successful exits before he founded Haatch, first taking Kiddicare from high street to online, then selling to Morrisons.

Brian and Sanjeev discuss how investors should decide how much money to put into venture capital and unquoted investments.

As a relative newcomer to the EIS industry, Andy Davidson of We Are Nova sees it a little differently to many of us.

Brian and Andy focus on the five reasons that startups fail, discussing what these are, why they are a problem and how Nova works to avoid them.

Hardware investing is a relatively niche area within EIS investing, but still has many attractions. Dr Ilian Iliev of EMV Capital talks about how the capital intensity has improved and why the ecosystem is attractive.

Film investing through EIS has changed radically since the patient capital review. Andeas Roald is CEO of Sovereign Media, whose background is in making films rather than simply financing them, talks about the return to more traditional structures.

While equity crowdfunding hasn’t taken off the way that many hoped, it is an important influence on startups and the EIS industry. Rob Murray Brown is one of the few crowdfunding experts outside the platforms, with strong opinions on what is and isn’t working for investors.

As investors, it is easy to focus on the process of making investments and forget that the real work happens afterwards. Dr Andy Round discusses supporting companies after an investment is made. We cover getting the right board in place and different sources of support, including various government schemes.

For the fifth episode of The EIS Navigator, Brian is joined by Pippa Gawley, Founder and Director of Zero Carbon Capital. They talk about Pippa’s belief that the climate crisis is the most important issue an investor can look to help solve, and discuss the challenges of small companies making meaningful contributions on a global scale.

For the fourth episode of The EIS Navigator, Brian is joined by Matthew O’Kane, MD of NIVL at Nexus Ventures. They discuss how to find and invest in good themes, with a couple of examples.

For this bonus episode of The EIS Navigator, Brian interviews Simon Thorn, Managing Partner of Acceleris. They discuss some of the options available to companies and what considerations they should think about when choosing an investor.

For the third episode of The EIS Navigator, Brian interviews Paul Miller, Managing Partner and CEO at Bethnal Green Ventures. They talk about running an accelerator, social impact investing and how companies can move from ideas to having a measurable impact.

For this bonus episode of The EIS Navigator, Brian interviews Mark Brownridge, Director General of the EIS Association. They talk about the Enterprise Investment Scheme, the Seed Enterprise Investment Scheme and Venture Capital Trusts from the perspective of investors and advisors.

For the second episode of The EIS Navigator, Brian interviews Dr Reuben Wilcock, Ventures Director at Blackfinch Ventures. They talk about the challenges of creating an investment process from scratch, including creating effective decision making.

For the first episode of The EIS Navigator, Brian interviews Andrew Castell from Par Equity in Edinburgh. They talk about angel investing, running an angel syndicate and the merits of being an angel versus a passive investor.

Coming on Tuesday 16th June, The EIS Navigator Podcast focuses on the UK venture capital industry, particularly areas supported by various government schemes including the Enterprise Investment scheme (EIS), the Seed Enterprise Investment Scheme (SEIS) and Venture Capital Trusts.

Your host, Brian Moretta, is Head of Tax Enhanced Services at Hardman & Co. He is an actuary turned fund manager, who then moved into equity research, and has examined many EIS funds, VCTs and companies. He also has some academic chops, being an Honorary Fellow at Heriot-Watt University where he does some occasional teaching. He has always had a strong interest in getting underneath companies and understanding how they really work, and he finds this space fascinating. Some of this is because transparency is hard, some because the industry is not well understood. The EIS Navigator podcast is an attempt to get beyond the superficial and shine a bit more light on what is going on.

Brian Moretta received Highly Commended at the EISA awards in 2021 and 2022 for the category Best Journalist or Advocate.

To contact us or give feedback, whether about the podcast or anything else, please email [email protected].